DFS Summary

Rhyolite Ridge Definitive Feasibility Study (DFS)

Cautionary Note: Economics and schedule shown on this page is per the DFS in April 2020 and has been subject to change.

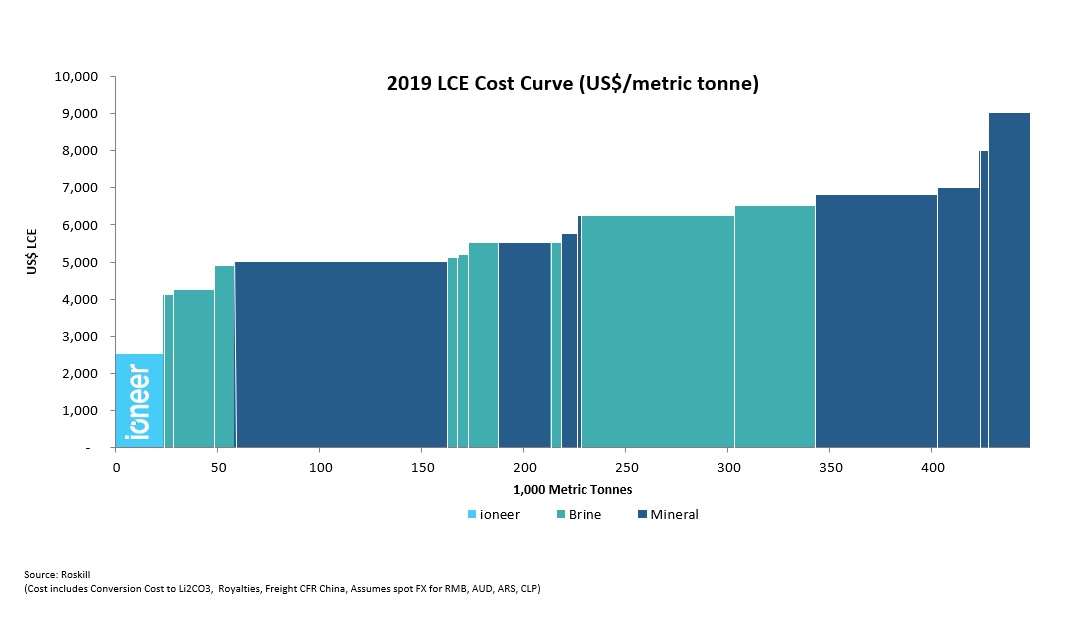

The Rhyolite Ridge Definitive Feasibility Study (DFS) was completed in April 2020. The DFS places the Project as the single most attractive project for the economic production of lithium carbonate, lithium hydroxide and boric acid globally. In addition, the analysis confirms Ioneer’s position as the lowest cost lithium producer globally with an estimated all in sustaining cash cost to produce battery grade lithium hydroxide of $2,5101 per metric tonne net of boric acid revenue.

The DFS confirms that the Project has a stable overall operating cost structure for the production of lithium carbonate and battery-grade lithium hydroxide due to the scale and reliability of its boric acid credit. The extensive bench and pilot scale tests conducted by Fluor, Kemetco Research and Kappes Cassiday, with support from Veolia and FLSmidth, has proven highly successful with excellent recoveries, the innovative use of proven processing technologies, and the production of high purity lithium and boric acid products.

The Company’s engineering partner, Fluor, has further developed and refined Project plans in the DFS to a 30% engineering complete level. The refinement of the DFS as compared to the PFS is substantial, and helps ensure predictable, sustainable, and low operating costs over the life of the Project. An important addition to the prior scope is the upfront inclusion of a steam turbine for power generation, which will provide the entire operation enough energy to be fully self-sufficient.

The DFS estimates that the total capital expenditure to complete the Project will be U.S.$785 million including an 8% contingency. This represents an increase of U.S.$186 million from the PFS, with nearly half of the increase in scope being driven by the inclusion of an on-site steam turbine, the purchase versus lease of the mining fleet, and the purchase of sulphur tankers to materially lower sulphur transportation costs. All of these decisions were made following detailed analysis of the options (trade-off studies) and have positive impacts to the overall Project economics.

The lithium and boron Mineral Resource is estimated at 146.5 million metric tons, including an Ore Reserve of 60.0 million metric tons, an increase in the Reserve from the previous estimate of 280% over the 26-year mine life. The mine plan is made up almost entirely of Reserve material and of that, nearly 50% is proven Ore Reserve. The resource remains open in three directions allowing for a potential extension to the life of the mine. Future exploration drilling will initially target the extensions of high-grade ore to the south, where it is expected to be increasingly shallow with positive impact on the mine plan.

Compelling Project Economics Confirmed by DFS

- After-tax NPV (8% real) of U.S.$1.265 billion, with unlevered IRR of 20.8%

- Average Annual Life of Mine (LOM) EBITDA of U.S.$288 million

- Average Annual Life of Mine (LOM) after-tax cashflow of U.S.$193 million

- Average Annual Life of Mine (LOM) revenue of U.S.$422 million

- LOM EBITDA margin of 68.1% based on average production

- Rapid payback of capital: 5.2 years from first production

All-in Sustained Cash Cost at the Bottom of the Global Cost Curve

- The lowest cost producer globally of lithium carbonate and lithium hydroxide, with an all-in sustaining cash cost at U.S.$2,510 per metric ton2

- Boron credit ensures industry-leading margins

Well Defined and Reliable Operating Cost and Capital Cost Estimates

- Capital estimate of U.S.$785 РAACE Class 3 capital cost estimate with an accuracy range of ±15%, including an 8% cost contingency

- Capital to construct the lithium hydroxide unit in year three is U.S.$74 million to be funded from free cash flow from operations and is included in the Company’s sustaining capital plan

- Conventional processing using proven commercial technology

- Low operating costs – AACE Class 3 estimate supported by an extensive test program including pilot plant and 30% of engineering complete

Long-Life Resource with Verified Expansion Potential

- Production to commence by the middle of 2023 with a 26-year mine life and the opportunity to extend and expand

- Producing ~20,600 metric tons of lithium carbonate or ~22,000 of lithium hydroxide 3 and 174,400 metric tons of boric acid per year, on average, for LOM

- Large resource, comprising a Mineral Resource of 146.5 million metric tons including an Ore Reserve of 60.0 million metric tons

- Highly prospective project area with further potential to increase total resource and reserves

U.S. Advantage and Low-Risk, Mining-Friendly Jurisdiction

- Nevada – first-rate, mining friendly jurisdiction

- Project is strategically located proximal to Tesla Gigafactory and California export ports

- Limited alternative supply of both lithium and boric acid within North America, which enhances the Project’s attractiveness to strategic partners

- Increasing electric vehicle manufacturing base in addition to Tesla in North America

Clear Path to Completion

- Detailed construction timeline developed in DFS

- Clearly defined permitting process

- Sustainable mining practices

- Current cash on hand sufficient to advance the Project through Final Investment Decision

- Robust, ongoing strategic partner and marketing discussions, as evidenced by recently executed long-term offtake agreement with a large boron customer

Footnotes

- All-in sustaining cash costs of U.S.$2,510 is the average cost per tonne to produce battery grade lithium hydroxide. It includes the cost to produce technical grade lithium carbonate and its conversion into lithium hydroxide (excluding conversion costs in the first 3 years when only lithium carbonate is produced).

- All-in sustaining cash costs of U.S.$2,510 is the average cost per tonne to produce battery grade lithium hydroxide. It includes the cost to produce technical grade lithium carbonate and its conversion into lithium hydroxide (excluding conversion costs in the first 3 years when only lithium carbonate is produced).

- Mineral Resource estimates include Ore Reserves