DFS Summary and Project Economics

Rhyolite Ridge Project Feasibility Study and Project Economics

A Rhyolite Ridge Definitive Feasibility Study (DFS) was completed in April 2020. The DFS placed the Project as a potential global leader for the economic production of lithium carbonate, lithium hydroxide and boric acid.

In October 2025 Ioneer published a technical report summary which serves as an update to the 2020 DFS.

Subsequently, Ioneer announced it had achieved material increases in lithium and boron production by decreasing leach retention time from three (3) days to two (2) days, and to one and a half (1.5) days. Throughout 2025, Ioneer has focused on increasing lithium yield (the quantity of lithium carbonate produced per tonne of sulphuric acid consumed) and optimising reagent efficiency.

For the first 25 years of operations, lithium carbonate equivalent (LCE) production at Rhyolite Ridge is now estimated to be 24,500 tonnes, and annual boric acid production of 135,500 tonnes. The estimates for 1.5-day leach retention represent annual production increases of approximately 30% for LCE tonnes and 15% boric acid tonnes, compared to 3-day leach retention.

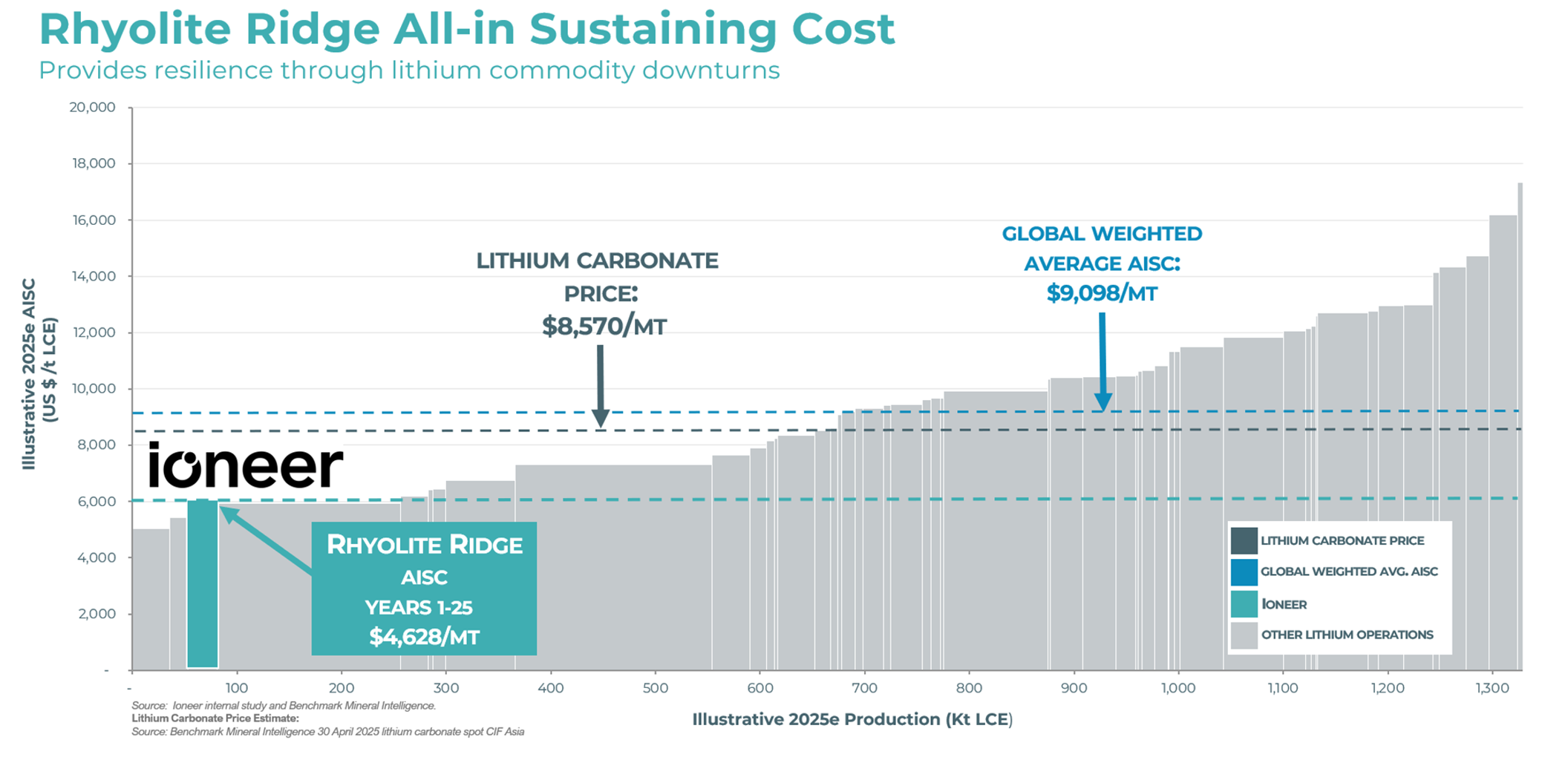

These updated findings position Ioneer, on a LCE basis, in the lowest cost quartile for lithium production globally with an estimated all-in sustaining cost (AISC) per LCE tonne of U.S. $4,628 – net of expected boric acid revenue – in the first 25 years. The unique mineralogy at Rhyolite Ridge, including co-production of boron, allows for the Project to remain globally competitive in various lithium pricing environments.

The Updated DFS confirms that the Project has a stable overall operating cost structure for the production of lithium carbonate and battery-grade lithium hydroxide due to the scale and reliability of its boric acid credit. The extensive bench and pilot scale tests conducted by Fluor, Kemetco Research and Kappes Cassiday, with support from Veolia and FLSmidth, has proven highly successful with excellent recoveries, the innovative use of proven processing technologies, and the production of high-quality, high-purity lithium and boron products.

Ioneer and its engineering partner, Fluor, have refined Project plans over the past four years and updates now include an Association for the Advancement of Cost Engineering (AACE) Class 2 capital cost estimate (-10%, +15%) with approximately 70% of the Project’s engineering complete. As a result of this and other engineering work including RAM analysis and detailed engineering design, Ioneer has adopted a more conservative approach to plant availability, equipment downtime and maintenance scheduling.

The updated Ore Reserve is now estimated at 266 million metric tons, containing 2,039 kt of Lithium Carbonate Equivalent (LCE) and 7,761 kt of Boric Acid Equivalent (BAE).

Compelling Project Economics Confirmed

- After-tax unlevered NPV (8% real) of U.S. $2.237 billion, with unlevered IRR of 18.0%

- After-tax levered NPV (8% real) of U.S. $2.299.9 billion, and after-tax levered IRR of 23.2%

- Average annual EBITDA of U.S. $563.4 (Years 1-25) and U.S. $416.6 million (LOM)

- Average annual revenue of U.S. $790.1 (Years 1-25) and U.S. $607.5 million (LOM)

- Lithium Revenue of $607.3 (Years 1-25) and U.S. $511.0 million (LOM)

- Boric Acid revenue of $182.8 (Years 1-25) and U.S. $96.5 million (LOM)

- LOM EBITDA margin of 71.3% (Years 1-25) and 68.6% (LOM)

- Payback of capital: 7 years from start of operations

All-in Sustained Cash Cost (AISC) Places Ioneer in Lowest Quartile for Lithium Production Globally ($US)

- The unique mineralogy at Rhyolite Ridge, including co-production of boron, allows for the Project to remain globally competitive in various lithium pricing environments.

- Rhyolite Ridge is expected to produce lithium carbonate and lithium hydroxide with an all-in sustaining cash cost (AISC) at U.S. $4,628 per metric tonne (Years 1-25) and U.S. $6,712 per metric ton (LOM) [A]

- Expected Direct Cost (C1) per tonne at U.S. $2,933 per metric tonne (Years 1-25) and U.S. $5,216 metric tonne [B]

Well Defined and Reliable Operating Cost and Capital Cost Estimates

- U.S.$1,683 million – AACE Class 2 capital cost estimate (-10%, +15%) including a 10% contingency

- Conventional processing using proven commercial technology

- Low operating costs – AACE Class 2 estimate supported by an extensive test program including pilot plant and ~70% of engineering complete

Long-Life Resource with Verified Expansion Potential

- Production to commence by 2029 with a 77-year mine life and the opportunity to extend and expand

- Annual lithium production (metric tonnes) of ~24,500 during Years 1-2 (carbonate), ~27,800 during years 3-25 (hydroxide) and LOM ~23,200 (hydroxide)

- Annual boric acid production (metric tonnes) of ~135,500 during Years 1-25 and LOM ~70,700

- Large resource, comprising an Ore Reserve of 266 million metric tonnes

- Highly prospective project area with further potential to increase total resource and reserves

U.S. Advantage and Low-Risk, Mining-Friendly Jurisdiction

- The Rhyolite Ridge Project is a fully permitted, large-scale, greenfield, lithium-boron project being developed on federal lands in Nevada in the United States

- Nevada is consistently rated as one of the world’s most favorable and stable mining jurisdictions

- Located in Esmeralda County, approximately halfway between Reno and Las Vegas, Nevada, and is easily accessible via state and county roads

- Unique lithium-boron mineralogy is the only known example of this type of deposit globally

- Large, long-life, low-cost operation and will play a vital role in supplying two critical materials (lithium and boron) into the US and global markets

- Lithium demand is projected to grow by more than 15% year over year, driven by batteries essential for energy storage and transportation

- Boron is an increasingly strategic material (designated in November 2025 as a “critical mineral” by the US Government) with more than 70% of global reserves concentrated in Turkey and only one large, mature mine operating outside of that country

Clear Path to Production

- Fully permitted and shovel-ready from an engineering design perspective

- All-in Sustaining Cash Cost in the lowest quartile of the Global Cost Curve

- Sustainable mining practices

- Long-Life Resource with Optimisation Upside and Verified Expansion Potential

- Closed DOE Office of Energy Dominance loan for U.S. $996 million [C]

- Current cash on hand sufficient to advance the Project through Final Investment Decision

- Robust, strategic partner process launched with Goldman Sachs in July 2025

The table below outlines key project metrics originally published in Ioneer’s announcement on

October 29, 2025 – “Further Leach Optimisation Enhances Project Economics”.

| KEY PARAMETERS | UNIT | YEARS 1-25 AVERAGE | LOM AVERAGE |

|---|---|---|---|

| PHYSICALS | |||

| Ore processing rate | Mtpa | 3.4 | 3.4 |

| Total tonnes processed | Mt | 86.2 | 265.5 |

| Lithium carbonate grade (equivalent) | % | 0.91 | 0.77 |

| Boric acid grade (equivalent) | % | 5.22 | 2.91 |

| Recoveries – Lithium carbonate | % | 81.7 | 80.0 |

| Recoveries – Lithium hydroxide (year three and beyond) | % | 96.0 | 96.0 |

| Recoveries – Boric acid | % | 74.7 | 62.4 |

| Lithium carbonate equivalent (LCE) production | tpa | ~24,500 | ~20,400 |

| Lithium hydroxide (year three and beyond) production | tpa | ~27,800 | ~23,200 |

| Boric acid production | tpa | ~135,500 | ~70,700 |

| OPERATING AND CAPITAL COSTS | |||

| LCE All-in Sustaining Cost (AISC) (net of boric acid credit) | US$/t LCE | 4,628 | 6,712 |

| LCE direct cost (C1) (net of boric acid credit) | US$/t LCE | 2,933 | 5,216 |

| Mining cost per ore tonne (inclusive of waste) | US$/t | 18.0 | 9.6 |

| Processing cost per ore tonne | US$/t | 55.8 | 49.3 |

| Mining cost per total tonnes (ore and waste) | US$/t | 2.32 | 2.21 |

| PRICING ASSUMPTIONS | |||

| Lithium hydroxide index price | US$/t | 23,040 | 23,012 |

| Boric acid price | US$/t | 1,296 | 1,368 |

| FINANCIAL PERFORMANCE | |||

| Annual revenue | US$Mpa | 790.1 | 607.5 |

| Annual revenue – Lithium | US$Mpa | 607.3 | 511.0 |

| Annual revenue – Boric acid | US$Mpa | 182.8 | 96.5 |

| Annual EBITDA | US$Mpa | 563.4 | 416.6 |

| Annual EBITDA margin | % | 71.3 | 68.6 |

| After-tax unlevered NPV @ 8% real discount rate | US$M | — | 2,237.3 |

| After-tax unlevered Internal Rate of Return (IRR) | % | — | 18.0 |

| After-tax levered NPV @ 8% real discount rate | US$M | — | 2,299.9 |

| After-tax levered Internal Rate of Return (IRR) | % | — | 23.2 |

| Payback period (from start of operations) | years | 7.0 | — |

| CAPITALIZED EXPENDITURE | |||

| Initial capital expenditure (including contingencies) | US$M | — | 1,683.2 |

| Sustaining capital expenditure | US$M | 916.6 | 2,168.1 |

| Capitalized deferred pre-stripping costs | US$M | 701.1 | 933.0 |

Footnotes

[A] AISC incorporates all C1 cash costs, sustaining capex and estimated interest on DOE Loan

[B] C1 cost includes raw materials, labor, utilities, maintenance materials, supplies, outside services and overburden storage costs

[C] The DOE Office of Energy Dominance loan is comprised of $968 million in principal and $28 million in capitalised interest and has conditions to first draw. See Company Announcement titled, “Rhyolite Ridge Lithium-Boron Project Closes US$996 Million DOE Loan Guarantee” dated January 17, 2025.